Get the free form 2210

Get, Create, Make and Sign

How to edit form 2210 online

How to fill out form 2210

How to fill out form 2210?

Who needs form 2210?

Video instructions and help with filling out and completing form 2210

Instructions and Help about fillable form underpayment

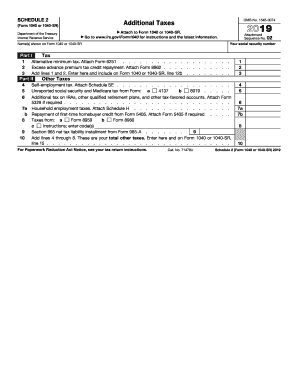

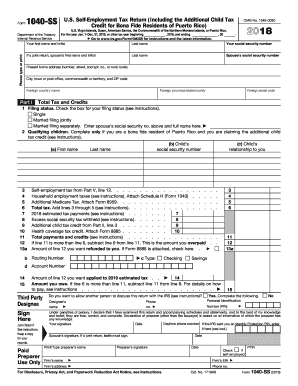

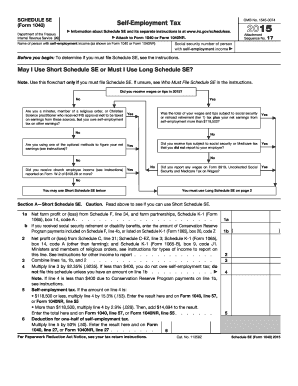

Thank you for your interest in Diem ice interest net software let's take a look at one of its many features interest net gives users the ability to set up and calculate a variety of IRS penalties in this video we will look at the estimated payment penalties these penalties are accessible from the navigation bars penalties group upon selecting the estimated payment option you will be prompted to create a new data file if you have not already done, so click ye sand type the name you wish to give your data file then click the Save icon select the designated area you wish to save your file and click Save upon creating the data file a default tax module will have already been added to the module list at the top of the screen since this module was automatically added to the system reedit module screen will automatically be displayed as well this is where the user can set the defining parameters of theta module use the available controls on the screen to select the parameters forth module such as jurisdiction tax type interest rate table and tax period you may also edit the description and tax IDF desired in this case we will set up module for form 1040 return for the year2011 for geography taxpayer note that unlike some other penalties in Interest net where the defining parameters forth module have little or no effect on the results and are for presentation purposes only for the estimated payment penalties ITIS crucial to at least properly establish the tax type and period of the module these parameters establish whether the penalty will be the corporate or individual variety form 20to 20 or 20 to 10 respectively as Wells the due date of the return once the parameters have been set click the Saveiconnow that the module has been established choose estimated payment from the navigation bar the estimated payment screen is generally laid out based on the actual IRS form for the year in question in this case form 20 to 10 forbear 2011 one exception to this is the top left section of the screen this section is where some basic penalty detail is displayed and entered certain elements such as the return year and due date will be based on the tax type and period of the module and cannot be changed other elements may or may not be applicable such as date of death for mere and settings for some options related to the form twenty to ten penalties such as non-resident alien farmer fishermen and no prior return the user should become familiar with how these settings will impact the penalty calculation by reviewing the applicable IRS publications before using them in the top right of the screen is the information in part one of the form twenty to ten which is for determining the required annual payment and it×39;exactly the same as the actual IRS forming this example we will input the following data amounts line one $35,000this is the tax amount for 2011 on line three we will input refundable tax credit of $750 finally on line eight Weill enter numb out for the...

Fill show a completed form 2210 : Try Risk Free

People Also Ask about form 2210

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your form 2210 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.